Spring Budget 2020 Summary

Posted on 13th March 2020 at 00:35

A summary of the main tax measures announced at the Spring Budget on 11 March 2020.

INTRODUCTION

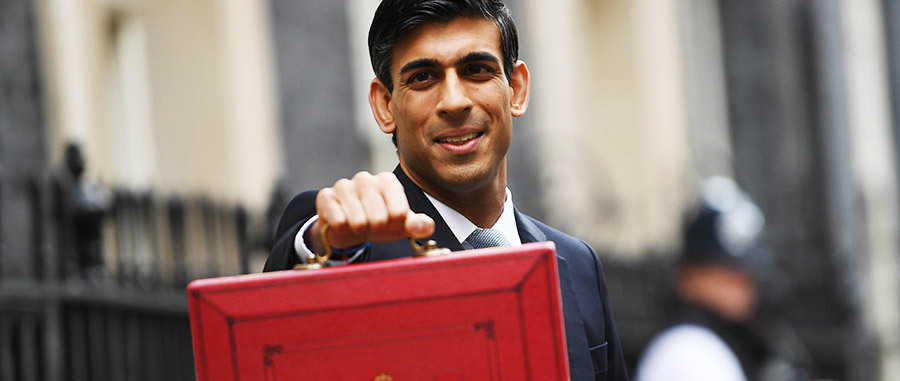

The Budget’ speech was the first for about 17 months and delivered only after 4 weeks in post by the new Chancellor of the Exchequer Rishi Sunak.

The absence of a Budget in the calendar year 2019 did give rise to some discussion as to when was the last time this happened. It is confirmed that we have another Budget in the Autumn to look forward to.

PERSONAL TAX

Rates and allowances for 2020/21

As already legislated for, the personal allowance remains at £12,500 and the basic rate limit at £37,500. Indeed, all income tax rates and allowances remain the same as for 2019/20 apart from cost of living increases to blind person’s allowance and married couple’s allowance.

The capital gains tax annual exempt amount is increased from £12,000 to £12,300.

The NIC Class 1 primary threshold (but not the secondary threshold for employer NICs) is increased to £183 per week equivalent to £9,500 per year. The Class 4 lower profits limit is similarly increased to £9,500. There is no change to the Class 1 upper limit or Class 4 upper profits limit.

The NICs employment allowance for employers is increased from £3,000 to £4,000 per year, but it is also worth mentioning that the allowance is being separately reformed, also from 6 April 2020, the National Insurance (NIC) Employment Allowance will be restricted to just small employers who have a Class 1 NIC liability below £100,000.

Inheritance tax thresholds and rates are unchanged, except that (as already planned) the residence nil rate band increases from £150,000 to £175,000 for 2020/21.

As regards pensions tax, the lifetime allowance is increased in line with inflation to £1,073,100 for 2020/21. The annual allowance remains unchanged at £40,000 (but see below for changes to the thresholds for calculating the tapered annual allowance).

Individual savings accounts and Child trust funds

The Individual Savings Account (ISA) annual subscription limit remains unchanged at £20,000 for 2020/21. However, the annual subscription limit for a Junior ISA is more than doubled to £9,000 (currently £4,368.

Off-payroll working rules

The government has recently concluded a review of the reform, and is making a number of changes to support its smooth and successful implementation. The government believes it is right to address the fundamental unfairness of the non-compliance with the existing rules, and the reform will therefore be legislated in Finance Bill 2020 and implemented on 6 April 2020, as previously announced.

EMPLOYMENT TAX

Pension tax changes

The adverse effect of recent pension changes on some high earners, such as doctors, has resulted in their having to refuse overtime in order to preserve their take home pay. This has arisen as a result of the tapering of the pensions’ annual allowance.

The annual allowance limits the maximum amount which individuals can contribute to their pension pots and for those with income, excluding pension contributions, of over £110,000, it is currently reduced by £1 for every £2 of adjusted income (income plus pension accrual) over £150,000 earned. From 2020/21 the income threshold is increased from £110,000 to £200,000 and the adjusted income threshold is increased from £150,000 to £240,000. In addition, the minimum tapered annual allowance will be reduced from £10,000 to £4,000.

Car and van benefits

The amount to which the appropriate percentage is applied in determining the taxable benefit of company car fuel is £24,500 for 2020/21 (£24,100 for 2019/20). The cash equivalent of the benefit of a company van for 2020/21 is £3,490 (2019/20 is £3,430). The cash equivalent of the benefit of van fuel for 2020/21 is £666 (£655 for 2019/20).

The Government also plans to reduce the van benefit charge to zero from 6 April 2021 for vans that produce zero carbon emissions.

The taxable benefit of cars provided to employees that are available for private use are based on the CO2 emissions figure. As previously announced, for all new cars provided to employees which are first registered from 6 April 2020 the CO2 emissions figure will be based on the worldwide harmonised light-vehicles test procedure (WLTP) figures. The benefit for cars registered before this date will continue to be calculated using the CO2 emissions figure under the existing New European Driving Cycle procedure.

Statutory sick pay

New legislation will temporarily allow statutory sick pay (SSP) to be paid from the first day of sickness absence, rather than the fourth day, for people who have coronavirus or who have to self-isolate in accordance with Government guidelines. The Government will also temporarily extend SSP to cover individuals who are unable to work because they have been advised to self-isolate, and people caring for those within the same household who display coronavirus symptoms and have been told to self-isolate. To take pressure away from GPs, self-isolating employees will be able to obtain a notification via NHS111 which they can use as evidence for absence from work.

Employers with fewer than 250 employees as of 28 February 2020 will be eligible for a refund of eligible SSP costs relating to coronavirus. This will be limited to two weeks per employee.

Tax deduction for homeworking

From 6 April 2020 the maximum flat rate income tax deduction available to employees to cover additional household expenses will increase from £4 to £6 per week where they work at home under homeworking arrangements.

NIC holiday for employers of veterans

The Government is introducing an NIC holiday for employers of veterans in their first year of civilian employment. From 6 April 2021 employers will be exempt from any employer’s NIC liability on the veteran’s salary up to the upper earnings limit.

Construction Industry Scheme (CIS) abuse

Legislation will be introduced in a later Finance Bill to prevent non-compliant businesses from using the CIS to claim tax refunds to which they are not entitled. The measure will allow HMRC to reduce or deny the CIS credit claimed on employer returns where the sub-contractor cannot evidence the deductions and does not correct their return when asked.

BUSINESSES TAX

Entrepreneurs’ relief

As widely anticipated, the Chancellor announced changes to Entrepreneurs’ relief. The relief, which allows company founders to pay capital gains tax at 10% when they sell their business, rather than 20%, had been under the microscope for a while following concerns that it is costing far more than was originally anticipated and didn’t entirely deliver on its objective to act as an catalyst for investment in and growth of entrepreneurial businesses.

He stopped short of abolishing the relief entirely but instead reduced the lifetime relief on gains eligible for relief to £1 million (from the pre-existing £10 million). This reduction has immediate effect – it will apply for all disposals on or after 11 March 2020, although special rules will apply for disposals entered into before 11 March that have yet to be completed.

Capital allowances

Expenditure on low CO2 emission cars, zero-emission goods vehicles and equipment for gas refuelling stations is to continue to qualify for 100% first year capital allowances for another four years. So expenditure will be eligible for relief if it is incurred before 31 March 2025 (5 April 2025 for income tax purposes). Note though that the threshold at which low emission cars are eligible for the FYA will reduce to 0g/km (previously 50g/km) from April 2021.

CORPORATE TAX

Digital services tax (DST)

As announced at Budget 2018, a Digital services tax (DST) applies from 1 April 2020 to tackle the tax treatment of digital business.

The DST is a 2% tax on revenues generated from search engines, social media platforms and online marketplaces where those activities are hose activities which are attributable to UK users. There is a £25 million per annum allowance and the DST only applies to groups that generate global yearly revenues of more than £500 million. A tax on revenue can have a higher impact on loss-making and start-up companies but there is a safe harbour provision that exempts loss-makers and reduces the effective rate of tax for business with very low profit margins.

Corporate tax rates

As expected, the Chancellor confirmed that the corporation tax rate will remain at 19% from 1 April 2020. Legislation will also be introduced to maintain this rate from 1 April 2021.

Research & Development

Several announcements were made in relation to the R&D regime:

● From 1 April 2020 the RDEC rate will increase from 12% to 13%

● The PAYE cap on the payable tax credit for the SME R&D scheme will be delayed until April 2021

● There will be a consultation on extending the scope of the R&D scheme to include expenditure on data and cloud computing

VAT AND INDIRECT TAX

VAT on e-publications

It was announced that the zero-rate of VAT which currently applies to physical publications (books, magazines, etc.) is to be extended to include e-publications with effect from 1 December 2020 (before the end of the Brexit implementation period). EU rules were amended in 2018 such that the UK is entitled to extend zero-rating in this way but the announcement was not widely anticipated. The changes come against the backdrop of litigation in the UK as part of which the Upper Tribunal has held that zero-rating can already apply to digital publications such as online newspapers (albeit HMRC has confirmed that it is appealing this decision). The Government has indicated that it will be consulting on the details of the legislation and it will not be included in Finance Bill 2020.

Plastic Packaging Tax

The Government confirmed the introduction of a plastic packaging tax. The idea was posited in Budget 2018 and a consultation took place in 2019. Now paving legislation will be introduced in Finance Bill 2020 and a further consultation on the detailed policy design has been launched. The consultation closes on 20 May 2020.

TAX ADMINISTRATION

HMRC automated processes

As already announced, the Government will introduce retrospective legislation to confirm that HMRC can use automated processes to issue taxpayers with notices to file returns and with penalty notices. Notices do not have to be issued by an individual officer. The use of automated processes had been challenged, with varying degrees of success, in a number of tribunal cases.

Protecting taxes in insolvency

It had already been announced that the Government would change the rules for businesses entering insolvency, so that more of the taxes paid in good faith by its employees and customers and temporarily held by the business go to fund public services rather than being distributed to other creditors. This will apply only to taxes collected and held by businesses on behalf of other taxpayers i.e. VAT and amounts deducted under PAYE and the Construction Industry Scheme. The changes had been expected to have effect from 1 April 2020 but will now be delayed until 1 December 2020. They will now be extended to Northern Ireland as well.

For further information, call us on 0333 772 7753 or email [email protected]

Tagged as: Budget 2020

Share this post: