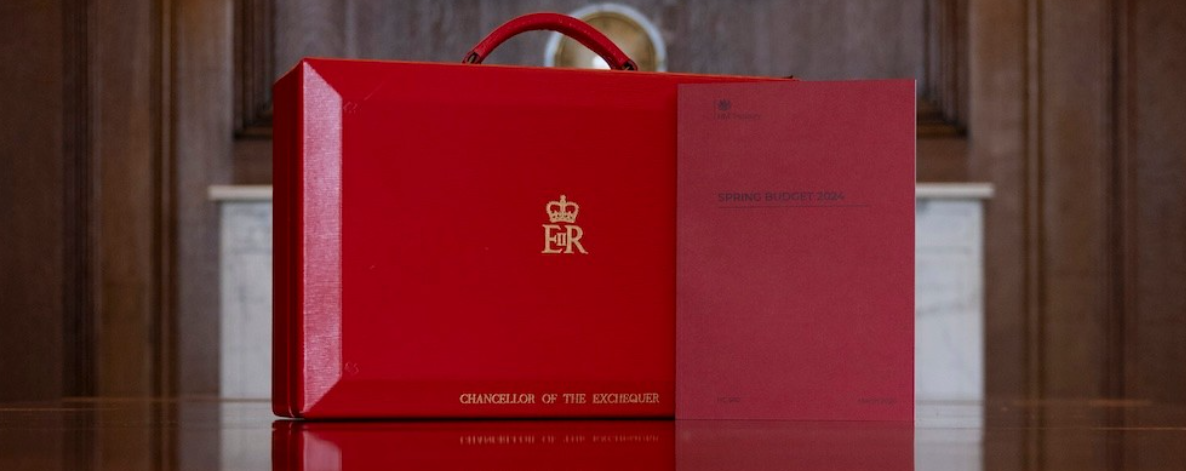

Spring Budget 2024 Highlights

Posted on 10th March 2024 at 19:35

Spring Budget 2024 What were the immediate points?

Jeremy Hunt announced his long awaited budget, it was never going to be spectacular but considering this is potentially the last one before the general election it is a great disappointment for small businesses and contractors with no reform of IR35.

2% cut to the rate of National Insurance from 10% to 8% for employees and from 8% to 6% for Self-employed

This translates to a saving of about £250 for someone earning £25,000 but no movement on Income Tax

Abolished multiple dwellings relief on SDLT

Originally put in place to support the private rental sector when buying multiple dwellings in one transaction, this will now increase the costs.

Abolished Furnished holiday letting regime.

Another cost to landlords as before they could claim Capital Allowances on items such as furniture, equipment and fixtures, and the profits count as earnings for pension purposes. This stops from April 2025.

Reduced the higher rate of capital gains tax (CGT) on property sales from 28 to 24%

This should be welcomed for any landlords who are downsizing and disposing of properties.

VAT threshold increased to £90,000

This has increased by £5,000, a welcome increase before registration is required but still low as this was originally frozen in 2017-18 and has been outpaced by inflation.

Reformed the high-income child benefit charge

The threshold has increased from £50,000 to £60,000, so a welcome move.

Introduced brand-new ISA which allows an additional £5,000 annual investment

A bonus for savers as interest rate are the highest they have been in a while and the returns are out of the scope of Income Tax.

Abolished the non-dom status

In theory this will make certain high net worth individuals liable to UK taxes on their world wide income.

Introduced duty on vaping products from October 2026 plus one-off

This is expected to raise£445m in 2028-29 while the increase in tobacco duty will only raise a further £170m, so even though this is not a business cost it does impact disposable income.

Frozen the fuel duty for the 14th year in a row for another 12 months, maintaining the 5p cut

With inflation currently at 4% this is common sense but a further cut would have helped.

Extended the alcohol duty freeze until February 2025

Made tax reliefs for orchestral productions permanent

£1bn in additional tax relief for creative industries over the next five years

Extended the windfall tax on oil and gas.

Share this post: